How Financial Education Empowers Communities

Financial education is more than just teaching individuals how to manage their personal finances—it’s about empowering entire communities. When people understand the fundamentals of budgeting, saving, investing, and managing debt, they not only improve their own financial well-being but also contribute to the overall economic health of their communities. Financial literacy plays a key role in breaking cycles of poverty, reducing financial stress, and promoting social mobility, which leads to stronger, more resilient communities.

When individuals within a community are financially literate, they can make better decisions about spending and saving, reducing reliance on credit and avoiding predatory lending practices. This leads to fewer financial crises, less debt, and more savings, which in turn can lead to greater economic stability for the community as a whole. Furthermore, financially educated individuals are more likely to invest in local businesses, participate in community-driven initiatives, and support each other’s financial goals, creating a culture of economic empowerment and growth.

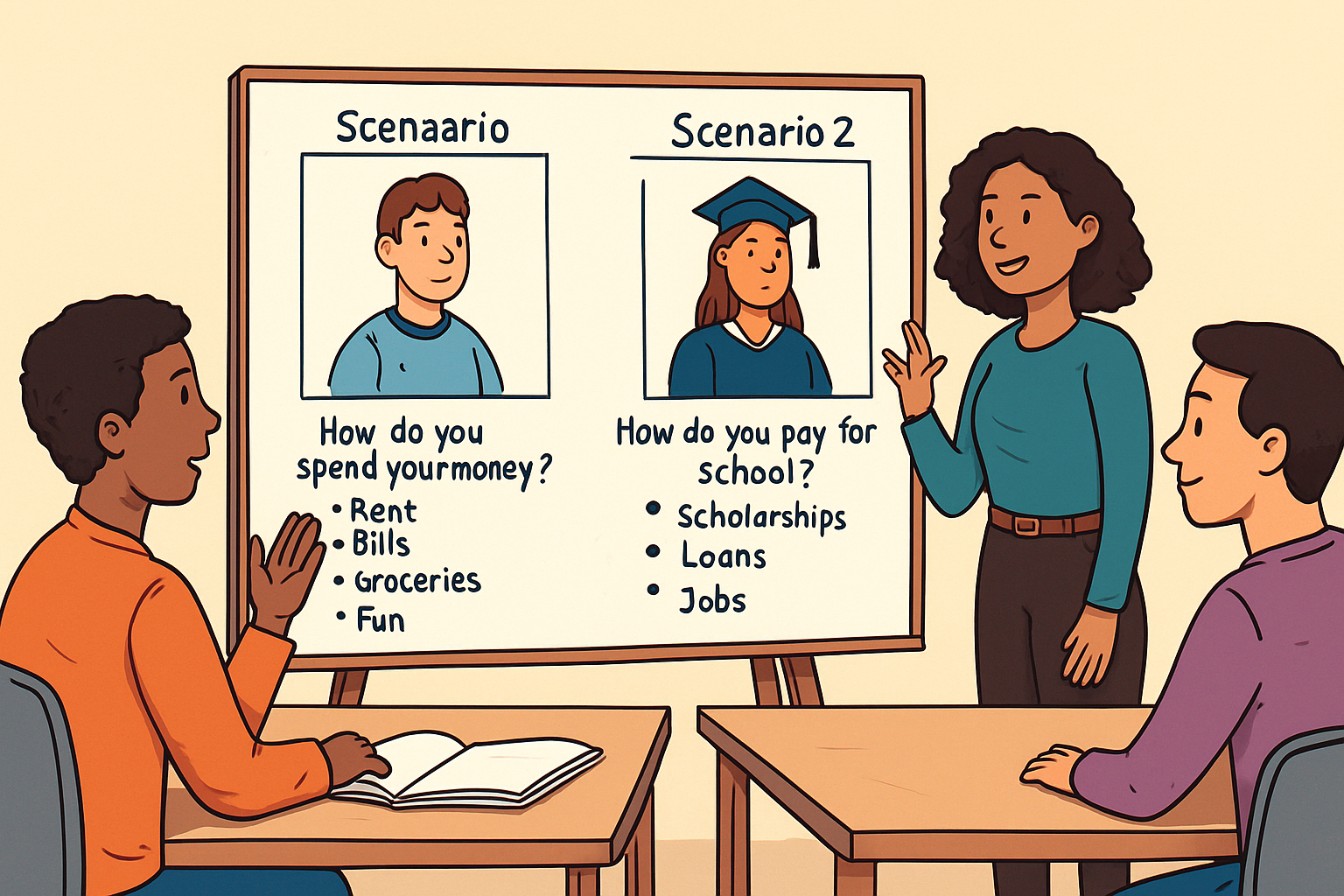

The FINMAN+ project aims to bring financial education to young adults, ensuring that they have the tools to make informed financial decisions. By training educators to deliver financial literacy programs, the project ensures that these valuable skills are passed on to future generations. As more people gain access to financial education, the ripple effects extend beyond individual benefits to entire communities, fostering an environment where people can thrive financially and contribute positively to the economy. Financial education truly has the power to transform communities, creating opportunities for everyone to prosper.